You and Citi share in the cost of your medical coverage. Citi pays about 70% of the cost, and you pay the rest through paycheck deductions. Citi’s philosophy is to support our lower-paid employees by contributing more towards their medical coverage. We believe strongly that all our employees should have access to affordable medical care. Everyone has different needs when it comes to benefits, and it’s important to us to meet those needs.

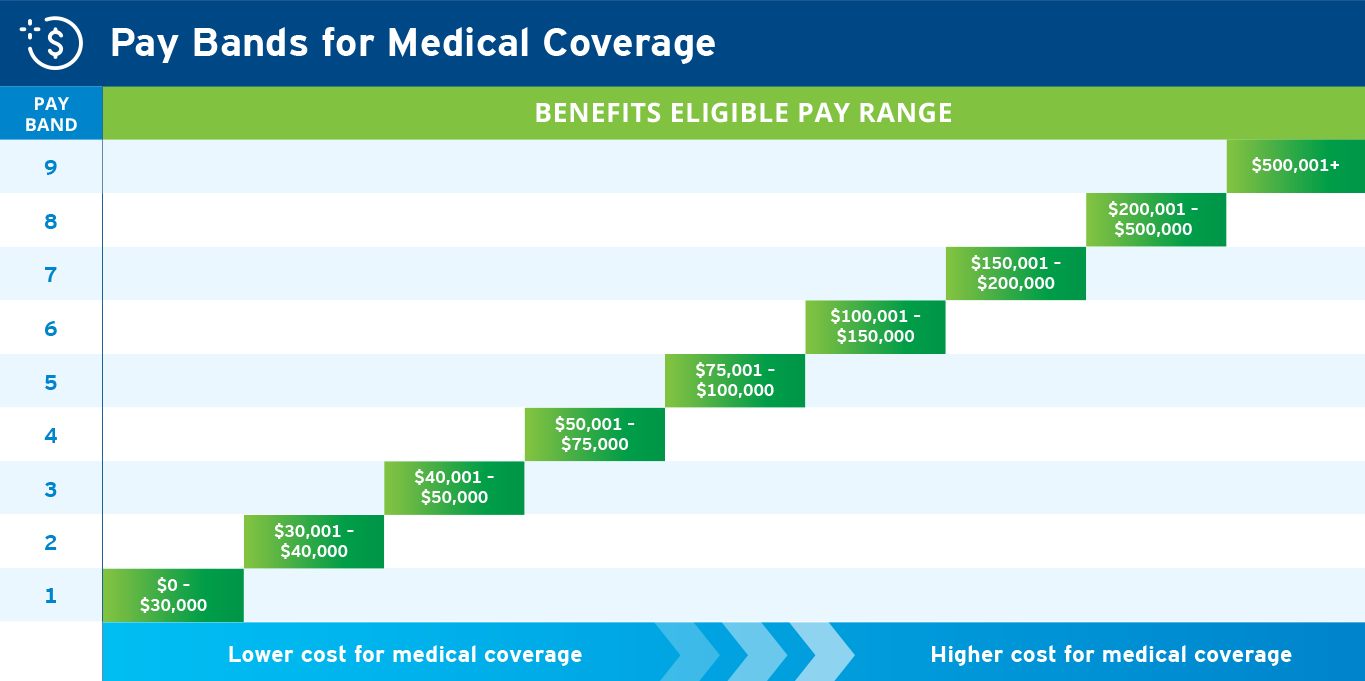

To support medical coverage more for our lower-paid employees, we look at each employee's benefits eligible pay and group employees into “pay bands." This means that medical benefits cost more for employees who make more, and less for employees who make less. The pay bands, shown here, help create that distribution of costs among our employees.

To determine what you will pay for medical benefits this year, go to Your Benefits Resources™ (YBR™), available through My Total Compensation and Benefits.

Benefits eligible pay

For most employees, benefits eligible pay means annual base pay as of June 30 plus the annual discretionary incentive award. In addition to medical coverage, benefits eligible pay is also used to determine your costs for other benefits, such as disability, life insurance, and eligibility for the Dependent Day Care Spending Account (DCSA) subsidy.

What you pay for medical coverage can also vary depending on many other things, including how many people in your family you cover and other decisions you make:

Pay Increases and Bonuses

Sometimes, a pay raise or a bonus can move you to a different pay band. If this happens, you will pay more for medical coverage the following year. (Your payroll contributions will change with the first paycheck in January; they won’t change in the middle of the year.) This won’t happen every time your pay increases; it only happens when your pay increase moves you to a different pay band.

For example:

Employee Promotion

Mike’s current benefits eligible pay is $47,000, placing him in the third benefits pay band. Mike received a promotion and a $5,000 increase to his annual salary, changing his benefits eligible pay to $52,000 and moving him into the fourth pay band for purposes of enrolling in medical benefits.

Because Mike is moving into a higher benefits pay band, what he pays to enroll in medical coverage will increase for the next plan year in comparison to what he would have paid for the same coverage when he enrolled during the current plan year.

Employee Bonus

Cheryl’s current benefits eligible pay is $98,000, placing her in the fifth benefits pay band. Cheryl received a $5,000 bonus earlier this year, increasing her benefits eligible pay to $103,000 and moving her into the sixth pay band for purposes of enrolling in medical benefits. While Cheryl did not receive a pay raise, the bonus she received counts towards her benefits eligible pay and increases her overall pay.

Because Cheryl is moving into a higher benefits pay band, what she pays to enroll her family in medical coverage will increase for the next plan year in comparison to what she would have paid for the same coverage during the current plan year.